The next Finance Commission will have a tough task

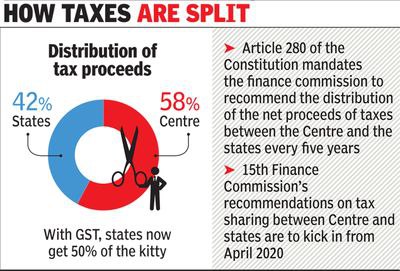

The government will soon appoint a Finance Commission to determine how much of the Centre's tax revenue should be given to the states and how to distribute it among them.

The next Finance Commission will have a tough task

The government will soon appoint a Finance Commission to determine how much of the Centre's tax revenue should be given to the states and how to distribute it among them.

Hence, it sees both vertical and horizontal distribution of revenues.

• The issue will be about horizontal distribution

Currently, the Centre gives away 41% of its tax pool to the States. Given the constraints of borrowing limits and the Centre's expenditure needs, the debate is focused on horizontal distribution.

When the previous Finance Commission was appointed in 2017, it faced flack by the states for taking into account figures of 2011 census. This, they argued, was not fair devolution to the states which had done well is stabilizing population growth rates.

Similarly, a conflict arises with regard to revenue deficit grants that the FC awards to States which remain in deficit on the current account even after tax devolution. The rationale behind it is that every state should be able to provide a minimum level of service to its residents. The issue is how to support deficit states without penalising responsible states.

Hence, every horizontal formula has faced criticism for being inefficient, and even blamed for an apparent "north-south gap".

• The terms of reference, issues and solutions

The terms of reference of the FC enjoin it to take into account the expenditure needs and revenue earning capacity of the Centre and the States.

Two issues that have been raised in particular are: the levy of cesses and surcharges by the Centre, and government spending on "freebies".

Perhaps suggesting a cap on the amount that can be raised by the Centre and a check on populist spending, as per the restraints imposed by the Fiscal Responsibility and Management Act could be possible solutions.

After the abolition of Planning Commision in 2014, the Finance Commission remains the sole architect of India's fiscal federalism. Therefore, its responsibility and influence are much larger. The next Finance Commission should bite the bullet in the interest of long-term fiscal sustainability and lay down guidelines on the spending on freebies.

• Article 280 of the Constitution provides for the establishment of Finance Commission

• It was created un 1951 to define the financial relations between the Centre and the states.

• the President has to constitute a Finance Commission of India every five years.

• The President lays the recommendation made by Finance Commission and its explanatory memorandum before each house of Parliament.